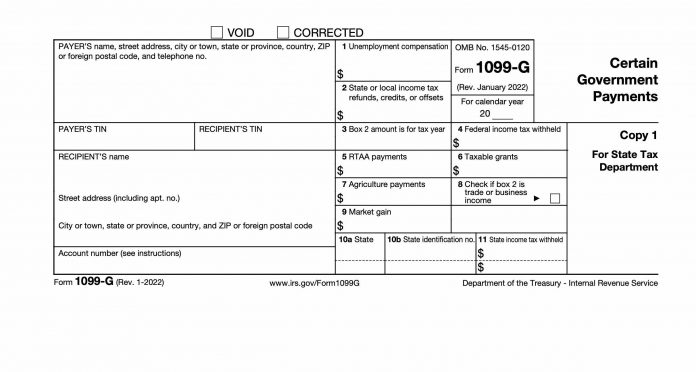

The Pennsylvania Department of Labor & Industry has provided additional guidance to Pennsylvanians who claimed unemployment compensation benefits in 2021 and are preparing to file their tax return using the 1099-G tax form. Department guidance is also available for individuals who suspect they are the victim of identity theft after unexpectedly receiving a 1099-G form.

While L&I mailed all 1099-G forms to claimants in January, access to 1099-G forms is also available to claimants via dashboards for traditional UC and for the Pandemic Unemployment Assistance program.

“The Department of Labor & Industry is committed to supporting UC claimants through every step of the process, especially new claimants who are unfamiliar with the system. During the annual tax season, this commitment extends to helping UC claimants correctly file their tax returns with the 1099-G form that the IRS requires from anyone who claimed UC benefits in the previous year,” said Secretary Jennifer Berrier. “We appreciate all of our partners who help us get the word out about these forms each year, and I encourage anyone with questions to visit our website for more information.”

The department has an extensive FAQ about 1099-G forms on its website to help claimants and other individuals with questions.

Claimants who suspect their 1099-G form includes an incorrect amount in “Total Payment” or “Tax Withheld” should first check the math.

– For traditional UC, find payment information on the UC dashboard. If the math is wrong, contact the UC service center. An updated 1099-G form will be issued to you.

– For PUA, to check the math, file an inquiry form online. Upon recalculation, a new form will be issued to you if the original form was incorrect.

Claimants who received both traditional UC benefits and PUA in 2021 should expect to receive two 1099-G forms, one for each program.

Claimants may notice that the physical 1099-G form looks different than the version on their dashboard. The mailed version is simplified, but both versions contain the information claimants need to file their tax return.

L&I assists claimants with 1099-G forms, but some questions, such as how to make adjustments after a return has been filed, must be referred to the IRS. Claimants with these questions should contact the IRS at 899-829-1040.

Because 1099-G forms are automatically generated for all claimants who received unemployment compensation payments, the receipt of a 1099-G form by a person who didn’t file for unemployment may indicate a case of identity theft. If you suspect you are the victim of identity theft involving UC fraud, report it to L&I. Click here for more information. Victims of identity theft should not wait to file their tax return. Only include true income, not the fraudulent income on the 1099-G form. More information about identity theft and 1099-G forms is available here.

If you suspect or know that someone is using your personal information (name, Social Security number, date of birth, etc.) without your knowledge or consent to file for UC benefits, report it to L&I by completing the Identity Theft Form online or calling the PA Fraud Hotline at 1-800-692-7469.

You can also file a police report with the municipality you resided in at the time the unemployment benefits in question were paid. If you are a victim of identity theft, you can also report it to the Federal Trade Commission and start a recovery plan at identitytheft.gov